Compliance-focused features for the financial services industry

Explore Syskit Point’s comprehensive and easy-to-use toolbox for compliance, financial data protection, and regulatory compliance of your entire Microsoft 365 environment.

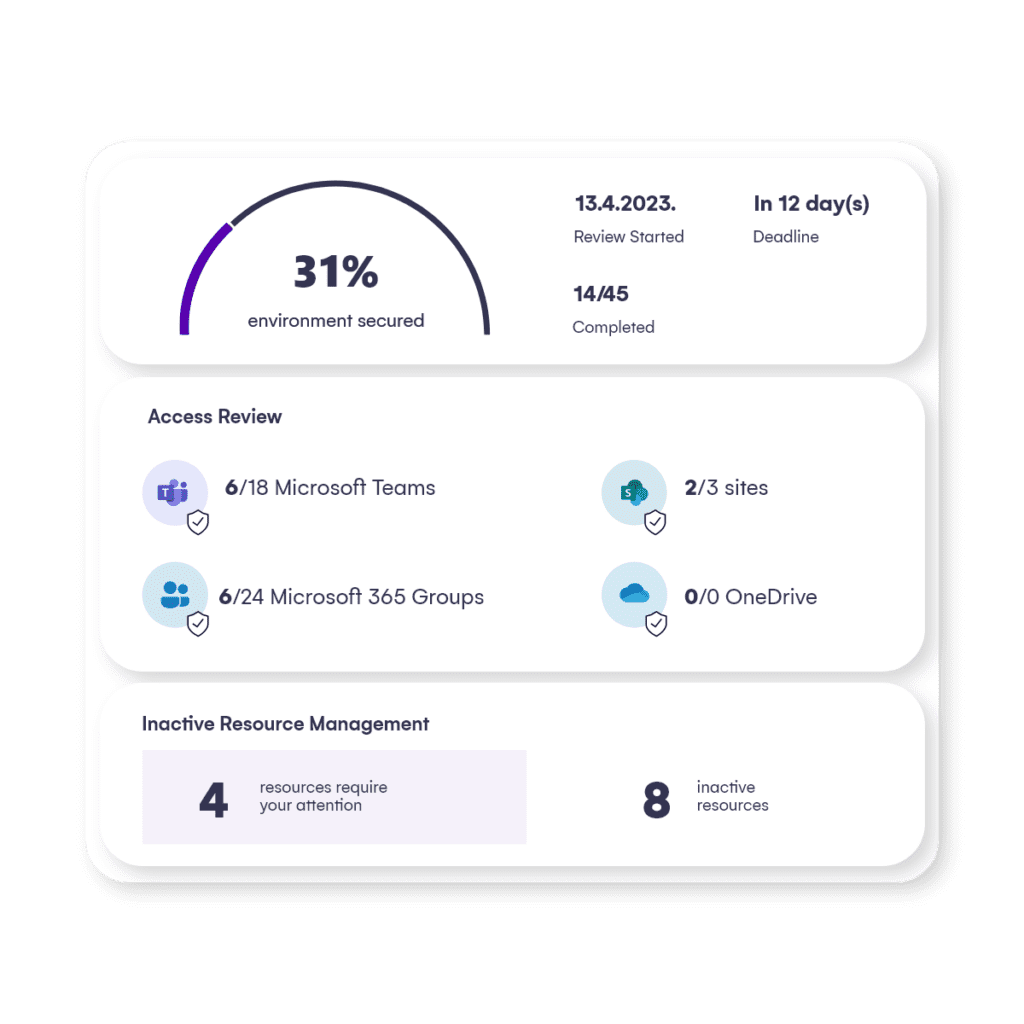

Syskit Point gives you complete control over data security, access permissions, and audit reporting across your Microsoft 365 environment, making it easier to meet industry regulations.

In the financial industry, institutions face a web of regulatory frameworks, including SOX, PCI DSS, GDPR, and many more.

Ensuring full compliance while managing access, data security, and regular audits can be overwhelming, and failure to meet these requirements leads to severe penalties.

Syskit Point simplifies complex compliance processes and helps you take control of your Microsoft 365 environment. It will give you full visibility into user access, help you automate compliance reporting, and ensure secure management of your sensitive financial data.

Explore Syskit Point’s comprehensive and easy-to-use toolbox for compliance, financial data protection, and regulatory compliance of your entire Microsoft 365 environment.

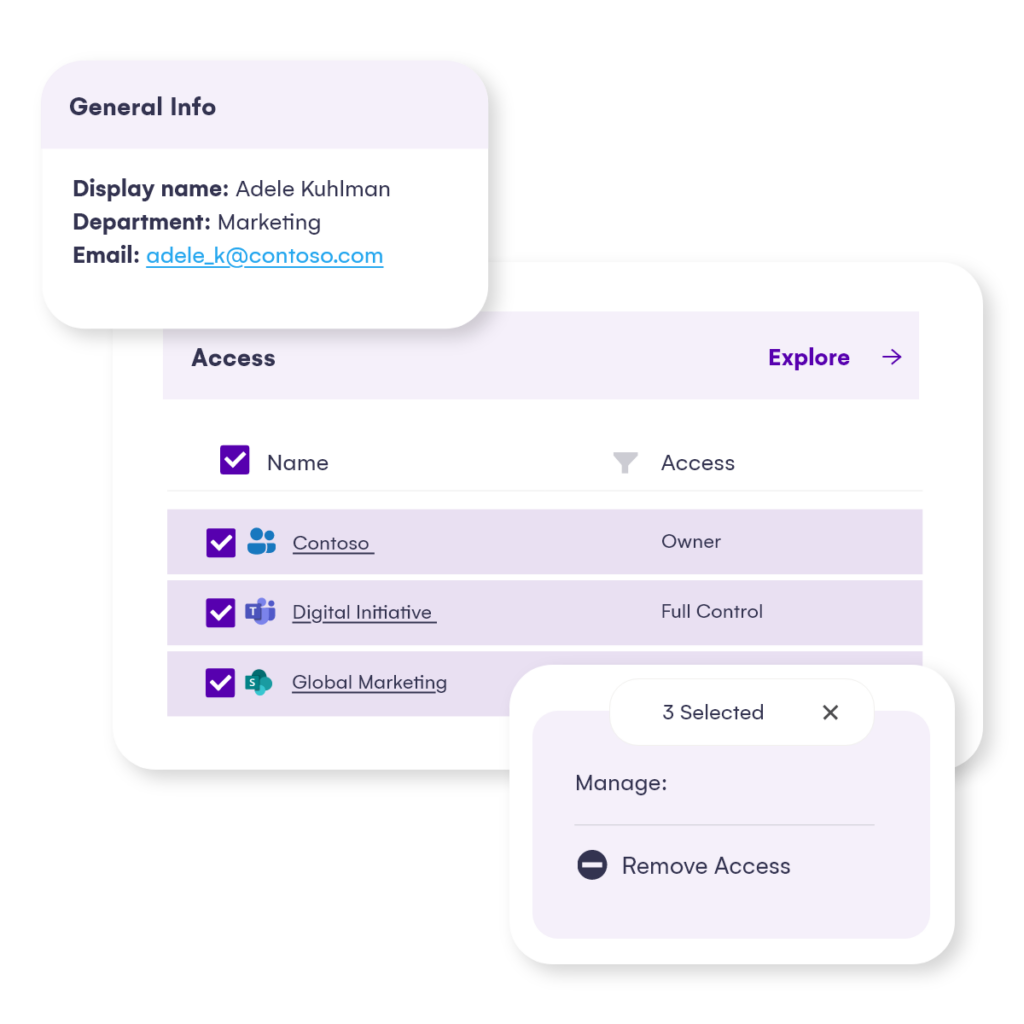

Protect your sensitive financial data with access controls and manage data access with ease. Syskit Point helps you comply with regulations such as GLBA and PCI DSS and ensures that only authorized personnel can access critical information.

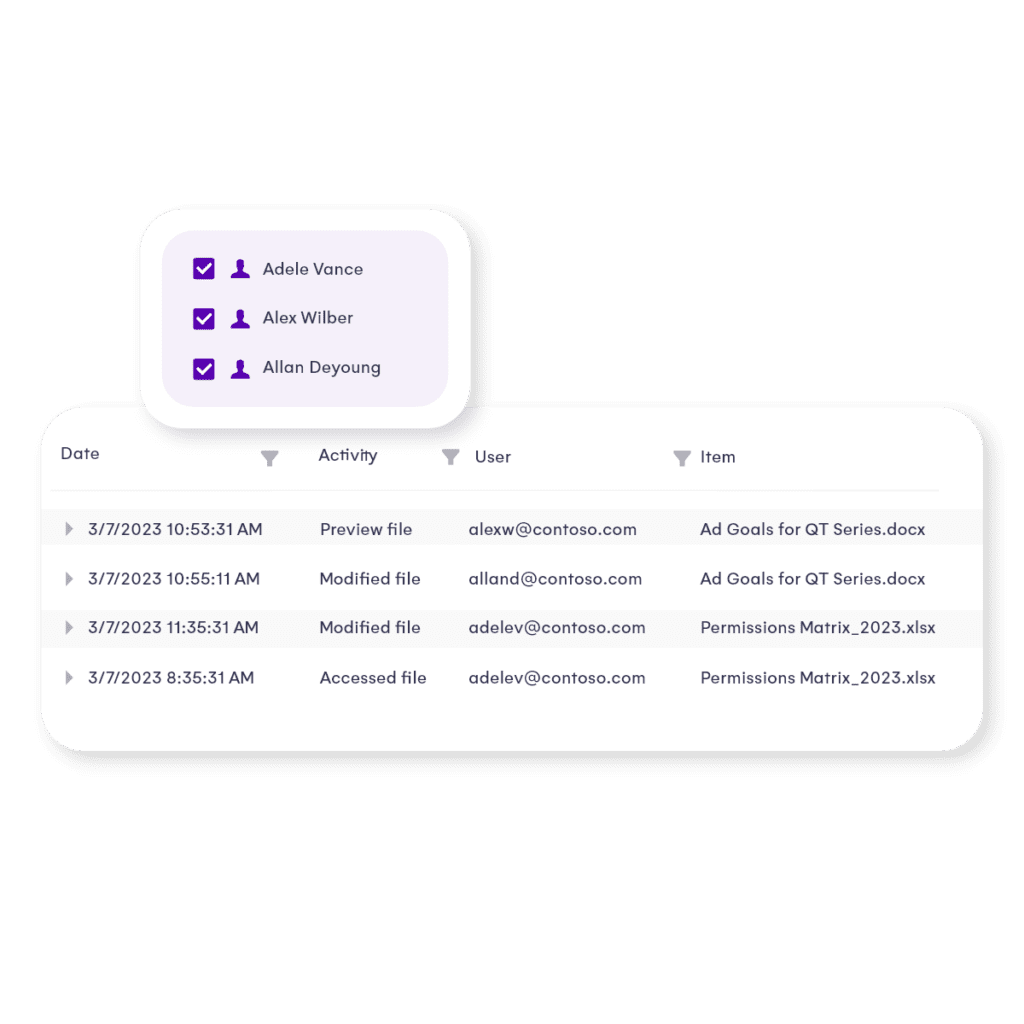

Maintain comprehensive audit logs of all user activities, document changes, and access events. Syskit Point automatically records all of this information, making it easier to demonstrate compliance with regulatory requirements.

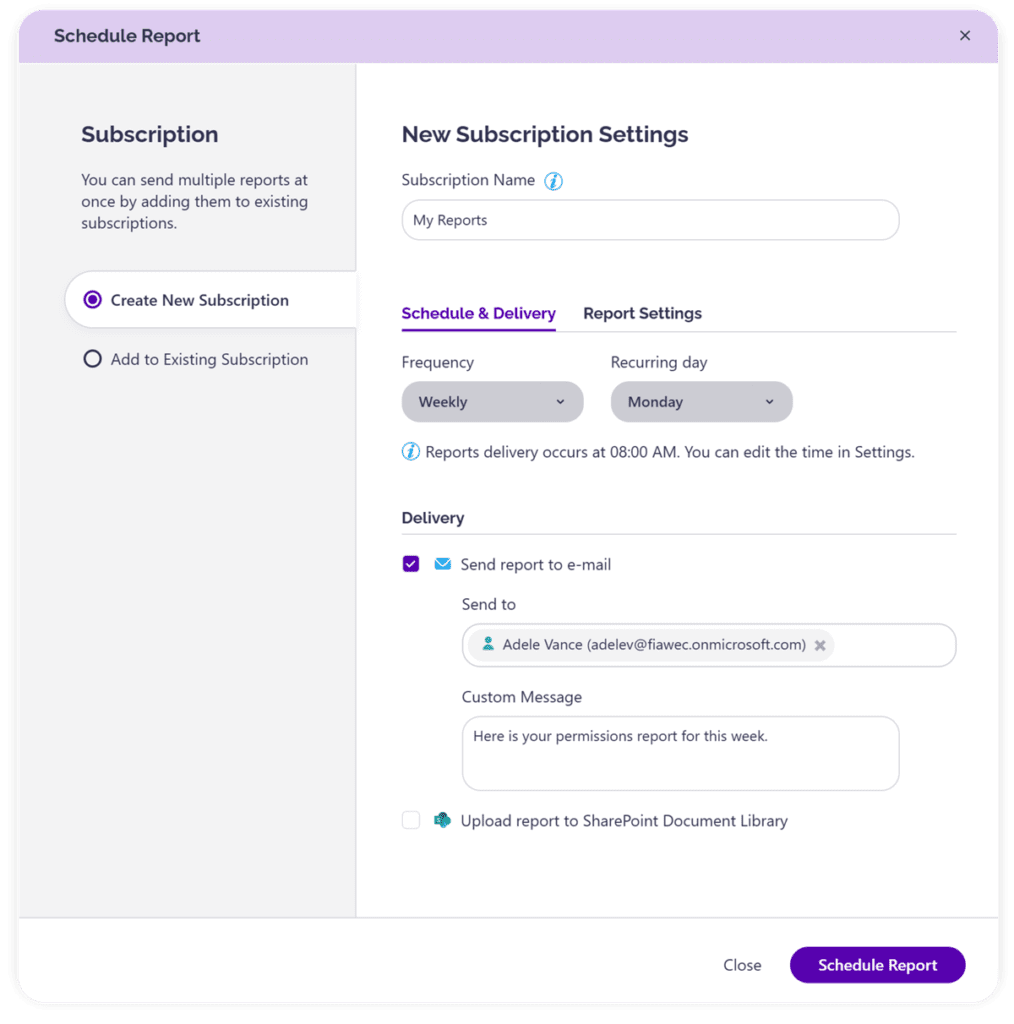

With Syskit Point’s customizable reports, you can easily provide evidence of compliance to auditors and regulatory bodies by generating and scheduling detailed compliance reports.

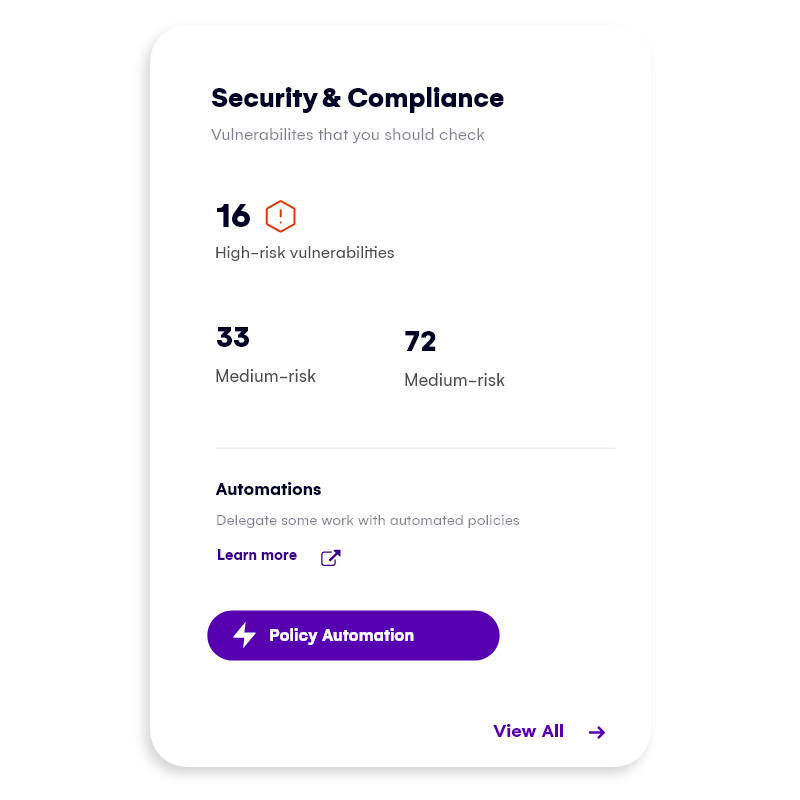

Maintain continuous awareness of your entire Microsoft 365 environment and stay alert for potential security risks and compliance gaps. Syskit Point provides real-time alerts for suspicious activities, access attempts, and changes to critical documents.

Define and effectively enforce compliance policies across your organization. Syskit Point helps you implement and uphold consistent security and data management practices, ensuring all users adhere to company and regulatory standards.

Sarbanes-Oxley Act (US) – This framework requires accurate financial reporting, audit trails, and internal controls.

Gramm-Leach-Bliley Act (US) – Focused on protecting consumer financial information, this act mandates secure data storage and access restrictions.

Dodd-Frank Act (US) – Requires financial institutions to manage risk, maintain transparency, and ensure accountability.

Payment Card Industry Data Security Standard (Global) – This standard mandates protecting cardholder data through encryption and strict access controls.

General Data Protection Regulation (EU) – Requires strict data protection, including breach reporting and respecting data subject rights.

Network and Information Security Directive (EU) – Focused on cybersecurity, NIS2 requires effective risk management and incident reporting.

Financial Conduct Authority (UK) – This regulation emphasizes market integrity, financial disclosures, and consumer protection.

Anti-Money Laundering & Know Your Customer (Global) – These regulations focus on verifying customer identities and monitoring transactions.

Get in touch to discover how Syskit Point helps organizations govern Microsoft 365 and stay compliant.